BRENTWOOD, Tenn. (BP) – Finding themselves in a tough financial hole, many people have attempted to use payday loans to dig themselves out.

Self-identified Christians living in the 27 states without meaningful regulations on those types of small, short-term unsecured loans often have a complicated relationship with payday advances and the lenders who offer them, according to a Lifeway Research study sponsored by Faith for Just Lending.

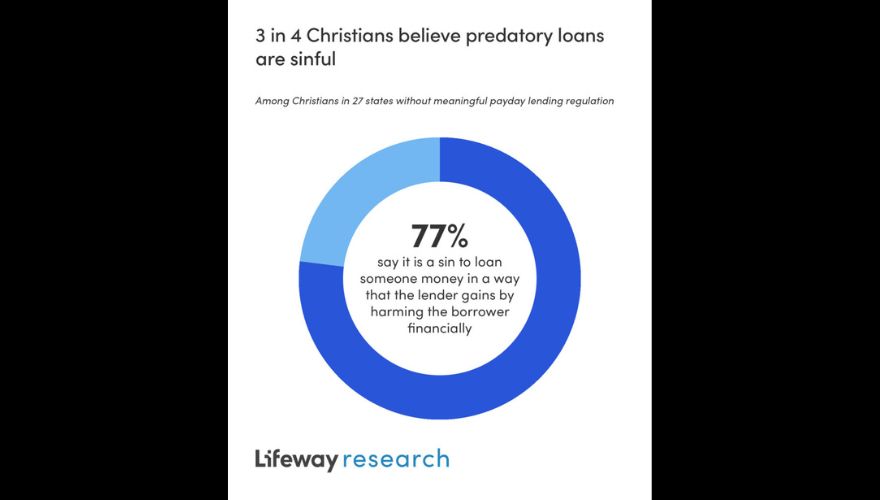

More than 3 in 4 believe it is a sin to loan money in a way that the lender gains by harming the borrower financially, and most describe payday loans as expensive. Still, 1 in 3 have obtained a payday loan themselves, and a growing number see such loans as helpful. Most also want some type of government intervention and church involvement around these issues.

“The proliferation of retail payday lending establishments has increased the first-hand knowledge many Christians have of these financial institutions,” said Scott McConnell, executive director of Lifeway Research. “The majority of Christians in states with few regulations on payday lending want more regulations that protect borrowers.”

Personal experience

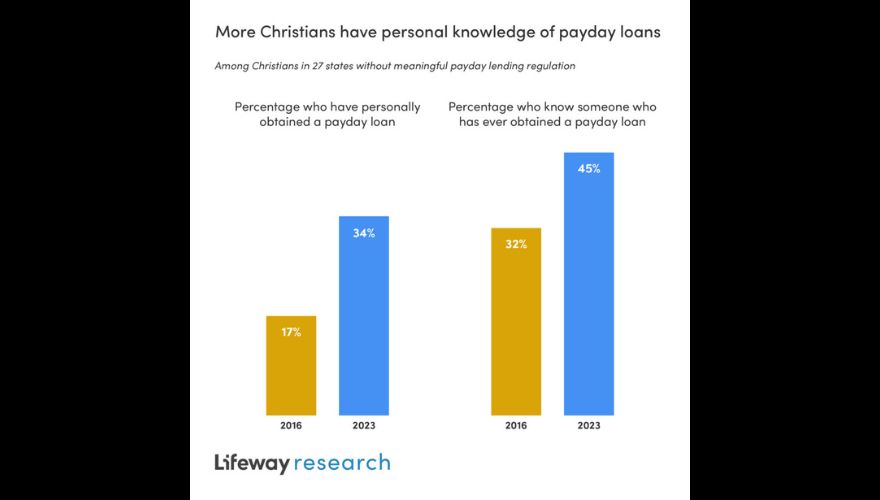

For Christians living in a state without significant regulations on payday lending, 34 percent have obtained that type of loan for themselves – double the 17 percent who said so in a similar 2016 Lifeway Research study. Additionally, 45 percent say they personally know someone who has gotten a payday loan, up from 32 percent in 2016.

When asked to choose which words apply to payday loans, most (57 percent) say expensive. More than 3 in 10 say harmful (32 percent) and predatory (31 percent). Another 10 percent say immoral. However, a growing number use positive terms. More than 1 in 3 say such loans are helpful (37 percent) and useful (35 percent), while 16 percent say timely. Those percentages are all more than double what they were in 2016, when 16 percent described them as helpful, 17 percent useful and 7 percent timely.

“Short-term financing is a real need for many Americans, so you expect to see a growing number of customers who appreciate the payday lending service,” McConnell said. “Yet, many describe payday loans with language that sounds more like warnings than endorsements.”

When asked directly, 77 percent of Christians in states with few regulations believe it is a sin to loan someone money in a way that the lender gains by harming the borrower financially. Less than 1 in 4 disagree (23 percent).

Christians are most likely to say their knowledge about fair lending practices comes from personal experience with their own loans (25 percent). Fewer say friends and family (18 percent), the Bible (10 percent), articles and news stories (9 percent) or their local church (3 percent) has influenced their thinking on the subject. Hardly any say they’ve learned about payday loans from the positions of elected officials (1 percent), national Christian leaders (1 percent) or teachers or professors (1 percent). One in 5 Christians in states where payday lending is less regulated (20 percent) haven’t thought about what lending practices are fair.

Regardless of their knowledge or experience, most Christians underestimate the percentage of payday loans that are rolled over into a new loan with additional fees after the first two-week period. According to a Consumer Financial Protection Bureau report, 82 percent of these loans are renewed within 14 days. Only 9 percent of Christians in states where payday loans are legal believe rollover rates are between 81 percent and 100 percent. Most (56 percent) believe 40 percent of the loans or less roll over, including 38 percent who say it’s 20 percent or less. More than 1 in 5 (22 percent) estimate 10 percent or less are renewed.

Government involvement

Christians in states without regulation seem supportive of increased government involvement in the industry. Close to 2 in 3 (63 percent) say 36 percent or less should be set as the maximum reasonable annual percentage rate (APR) of a loan, with 39 percent saying it should not go above 12 percent. Only 7 percent believe there should be no maximum reasonable APR.

More than 3 in 4 (78 percent) believe laws or regulations should protect borrowers from lending practices that create loans that can’t realistically be repaid without additional loans. Specifically, 84 percent say laws or regulations should prohibit lending at “excessive interest rates.” Fewer than 1 in 10 (8 percent) say no to either proposal.

More than 9 in 10 (94 percent) agree that lenders should take into account the borrower’s income and expenses and only extend loans at “reasonable interest rates” based on ability to repay within the original loan period.

“Christians expect far more regulations that protect borrowers than exist in these states,” McConnell said. “The Bible does not define at what rate excessive interest begins, but it does forbid it. So, it is not surprising that most Christians want to eliminate excessive interest rates (APR).”

Church response

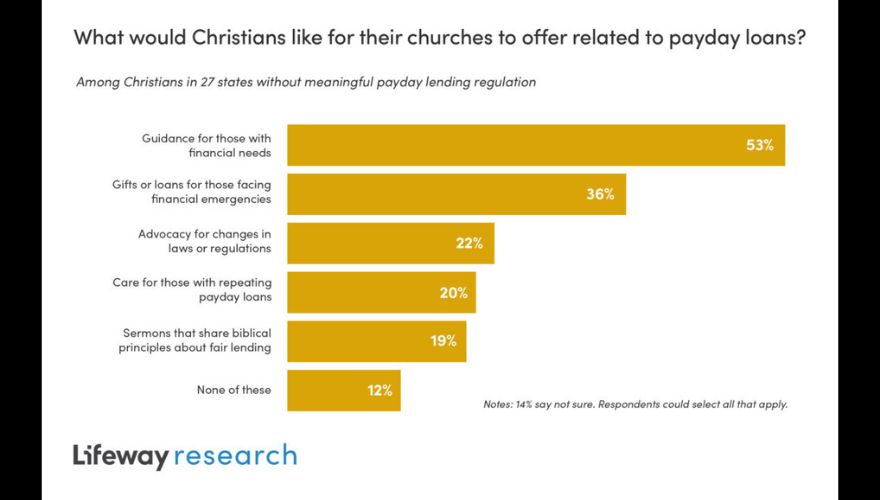

While Christians in states where payday lending exists with little to no regulation want legal responses to the industry, most also expect the church to be involved in addressing the issue.

Nine in 10 (89 percent) believe churches should teach and model responsible stewardship and offer help to neighbors in times of crisis, up from 83 percent who said so in 2016.

When asked what they’d like to see their church offer related to payday loans, most (53 percent) point to guidance for those with financial needs. More than a third (36 percent) would like to see their church provide gifts or loans for those facing financial emergencies. Around 1 in 5 want their congregation to advocate for changes in laws or regulations (22 percent), to care for those with repeating payday loans (20 percent) or to deliver sermons that share biblical principles on fair lending (19 percent).

Around 1 in 10 (11 percent) say their local church offers guidance or assistance related to payday loans. Around 2 in 5 (39 percent) say their church doesn’t provide those. Half (50 percent) aren’t sure. Compared to 2016, more Christians say they know whether their church is helping or not. Those who say their congregation provides assistance increased from 6 percent, while those who say their church does not offer help rose from 34 percent. The percentage who say they aren’t sure fell from 61 percent seven years ago.

Still, Christians in states with little to no regulation on payday lending say they’re looking to their church to provide some guidance and help on the issue, but McConnell says too many aren’t finding it. “Most churches are silent on payday loans at times when Christians desire advice and emergency help,” he said.

For more information, view the complete report or visit LifewayResearch.com.

Methodology

The online survey of Americans in 27 states was conducted Feb. 22-27, 2023. The project was sponsored by Faith for Just Lending. A demographically balanced sample from a national online panel was used. This sample was screened to only include adults who indicate a Christian religious preference (Catholic, Orthodox, Black churches, mainline, evangelical, and non-denominational). Maximum quotas and slight weights were used for gender, region, age, ethnicity and education to more accurately reflect the U.S. adult population. The completed sample is 1,000 surveys. The sample provides 95 percent confidence that the sampling error does not exceed plus or minus 3.3 percent. This margin of error accounts for the effect of weighting. Margins of error are higher in sub-groups.

Twenty-seven states were selected by Faith for Just Lending because they do not have meaningful regulation on payday lending. The following states are included in the analysis: Alabama, Alaska, California, Florida, Hawaii, Idaho, Indiana, Iowa, Kansas, Kentucky, Louisiana, Michigan, Minnesota, Mississippi, Missouri, Nebraska, Nevada, New Mexico, Ohio, Oklahoma, Rhode Island, South Carolina, Tennessee, Texas, Utah, Wisconsin and Wyoming.

(EDITOR’S NOTE – Aaron Earls is a writer for Lifeway Christian Resources.)