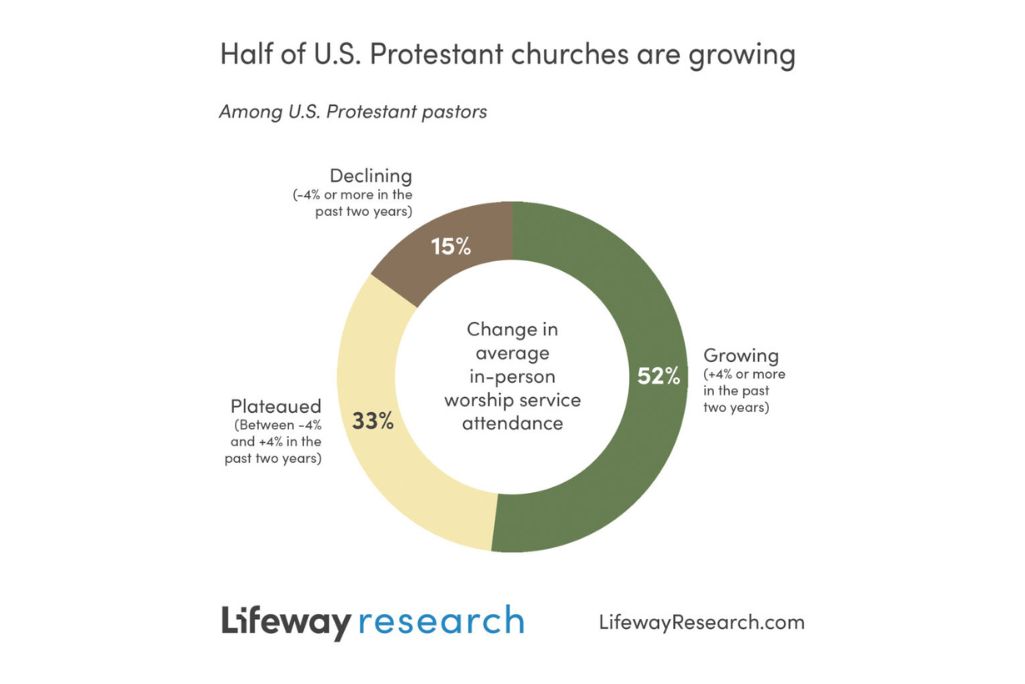

BRENTWOOD, Tenn. — Half of U.S. Protestant pastors say their churches are growing, but some warning signs remain about their congregational future.

U.S. Protestant churches are almost evenly split between those that have grown within the past two years and those that are plateaued or declining, according to an Exponential study by Lifeway Research.

Around half of the congregations (52%) increased their worship service attendance by at least 4% in the past two years. The other 48% of churches have either remained within plus or minus 4% since 2022 (33%) or declined by at least 4% (15%).

“Clearly, the last two years of attendance growth was aided by people returning to regular attendance after being away since the start of the pandemic,” said Scott McConnell, executive director of Lifeway Research. “Most pastors wish they had returned earlier, but their attendance is a source of optimism, though future growth will need to come from brand new contacts.”

In general, the large are growing larger and the small keep getting smaller. Congregations with more than 250 in attendance (62%) and those with 100 to 250 (59%) are more likely than churches with 50 to 99 in attendance (45%) and those with fewer than 50 (23%) to be growing by 4% or more.

Evangelical pastors are more likely than mainline pastors to say their church is growing (57% v. 46%). Denominationally, Holiness (63%), Pentecostal (62%) and Baptist congregations (59%) are more likely than Methodist (43%) and Lutheran churches (37%) to be experiencing growth of at least 4%.

Churches seeking to capitalize on any momentum from post-pandemic attendance gains would need to continue to reach new individuals, raise new leaders, support new churches and have the finances to accomplish all three.

Christian commitments

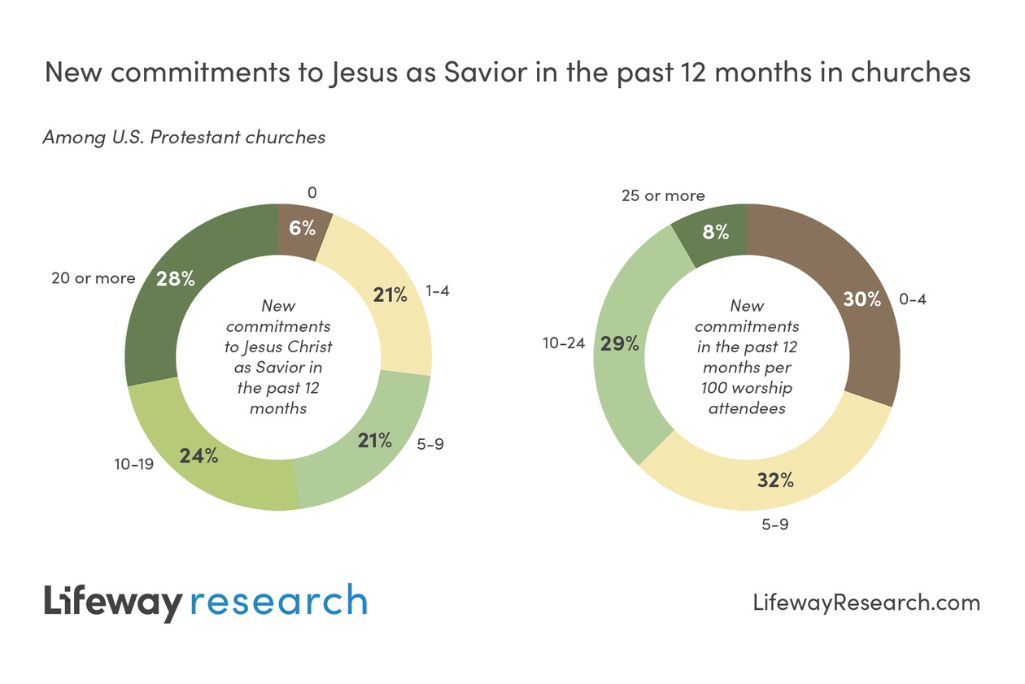

Around half of U.S. Protestant churches have seen at least 10 people indicate a new commitment to Jesus Christ as Savior through their church in the past 12 months.

Specifically, 6% of congregations saw no new commitments, 21% had some but fewer than five and another 21% saw at least five but fewer than 10. Around a quarter (24%) saw between 10 and 19 new commitments to Jesus in the past 12 months, while 28% of churches saw 20 or more.

Because congregations have different numbers of people who can engage in evangelism, evaluating the decisions per 100 attendees may give a more accurate perspective on how effective churches are at reaching new people.

Three in 10 churches (30%) saw four or fewer new commitments per 100 attendees. Around a third (32%) saw between five and nine decisions to become a Christian. Another 3 in 10 (29%) had 10 to 24 new commitments per 100 attendees. Far fewer (8%) reported 25 or more new decisions in the past 12 months. The average church saw around seven decisions per 100 attendees.

“While studies find most churches falling short of pre-pandemic numbers, this study finds a small uptick in conversions per attendee,” McConnell said. “Many churches are being intentional about sharing the gospel with the next generation and those outside their churches.”

Churches have been more evangelistically effective compared to a 2019 Exponential and Lifeway Research study. In 2019, 67% of congregations saw fewer than 10 new commitments per 100 attendees, while 34% saw 10 or more. Today, 62% of churches have reached fewer than 10 new people, while 38% say they’ve seen 10 or more commit their lives to Jesus.

Leadership development

As churches reach new people and disciple those already there, most say they have a plan to develop leaders. Four in 5 Protestant pastors (81%) agree their churches have an intentional process to move people from participating to leading a small group or team or leading ministry inside and outside of the church, including 39% who strongly agree. Fewer than 1 in 5 (18%) disagree, and 2% aren’t sure. Evangelical pastors are more likely to agree than mainline pastors (84% v. 78%).

Most pastors (57%) have some leadership development program in place within their congregations. More than 2 in 5 (43%) have a program designed to train individuals to lead a specific ministry by working in the ministry at least part-time for less than a year. Slightly fewer (37%) have a similar program where the individuals work in the ministry for a year or more. Around 1 in 5 (21%) have a summer internship program, while 43% of churches don’t have any of those.

“Investing in young, diverse leaders today is not just an act of discipleship. It’s a commitment to multiplying the church for tomorrow,” said Carrie Williams, executive director of Exponential NEXT. “When we nurture their unique gifts and perspectives, we empower a generation to reach the world with the gospel in ways we’ve never imagined.”

In general, larger churches and evangelical congregations are more likely to have these types of leadership pipelines.

Church planting and outreach

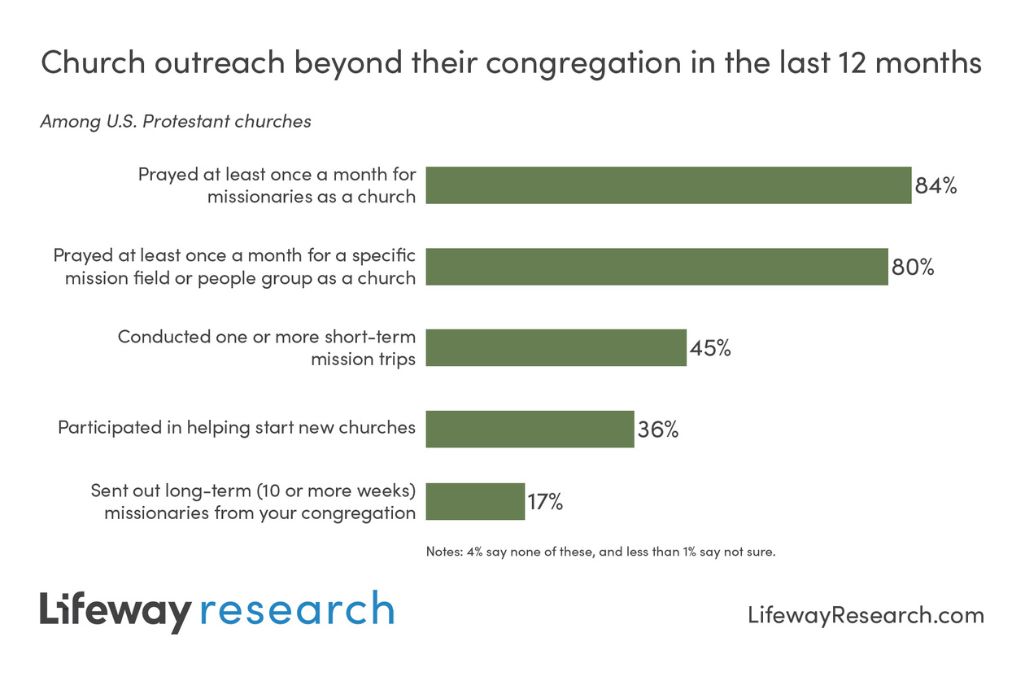

More than 9 in 10 churches have engaged in at least one of five ways to see new people become Christians and grow as disciples, including around a third who have participated in planting a new church.

Churches are most likely to have prayed for missionary efforts. At least 4 in 5 pastors say in the past 12 months their churches have prayed at least once a month for missionaries as a church (84%) and prayed at least once a month for a specific mission field or people group as a church (80%). Almost half (45%) have conducted one or more short-term mission trips.

Fewer congregations are involved in more long-term efforts. Slightly more than a third (36%) say they participated in helping start a new church in the past 12 months. Fewer than 1 in 5 (17%) have sent missionaries from their congregation for trips lasting 10 or more weeks.

While 36% of churches say they have participated in church planting in some way, this involvement varies. Among these churches, more are involved in the preparation work needed for church planting compared to 2019. More are assessing (30% v. 23%), training (42% v. 21%) and coaching (38% v. 29%) potential church planters than previously. Despite growth in planter development work, only 2% of all churches have accepted direct financial responsibility as the primary sponsor of a new church in the last three years.

Evangelical pastors are more likely than their mainline counterparts to say their churches have prayed at least once a month for missionaries (89% v. 78%), prayed at least once a month for a specific mission field or people group (84% v. 78%), helped start a new church (40% v. 30%) and sent out long-term missionaries (18% v. 8%).

Few churches say they have started a new multisite campus in the past three years. More than 9 in 10 (94%) say they haven’t started a new campus, while 5% say they’ve started one campus, 1% have started two and another 1% say they have started three or more in the past three years.

Budget and giving

Almost half of churches (46%) report 2024 giving to be higher than 2023 levels. A third (34%) say offerings were the same as 2023. Fewer (16%) saw giving drop from 2023 to 2024, while 4% aren’t sure.

As churches have more money coming in, many pastors expect to have more going out. Around 2 in 5 (43%) say their congregational spending will be more than 3% higher in the next 12 months than it was in the previous 12 months. Another 41% say spending will be within 3% of the last 12 months. Only 1 in 10 expect spending will be more than 3% lower than it was previously.

Any spending changes are likely not caused by changes to the number of paid staff members. Seven in 10 churches (71%) say their number of paid staff stayed the same in 2024 compared to 2023. Almost 1 in 5 (18%) say paid staff increased, while 9% decreased staff members. Just 1% of congregations say they have no paid staff including no paid pastor.

Most churches expect staffing to continue at the same levels. Seven in 10 (73%) say the paid staff will stay the same in 2025 compared to 2024. Almost a quarter (22%) say it will increase, while 3% are planning for a staffing decrease.

“About a quarter of churches are seeing growth in church offerings that have the potential to fund new ministry ventures, while others with revenue growth are likely just stretching it to cover inflation,” McConnell said.

Around a quarter of Protestant churches say they direct more than 1% of their budget directly to church plants or church-planting efforts, not including general contributions to a network or denomination. Three in 4 churches (75%) say 1% or less of their budget supports church planting directly. Mainline pastors are more likely than evangelical ones to say they’re giving 1% or less for church plants (81% v. 67%).

When asked what prevents them from giving more to church planting, pastors point to their current commitments and congregational struggles.

Most churches say they don’t financially support church planting more because they have existing commitments to fund specific ministries (79%), choose to give to their network or denomination that does similar activities (75%) and have existing commitments to fund missionaries directly (65%). Another quarter (27%) say they don’t have enough money to cover their own monthly expenses.

Pastors feel their church would be motivated to give more for church planting under certain conditions. Most say they would likely financially support church planting more if their congregation connected with the need for a church plant for a specific area or people (72%) and if they knew the church planter personally who they were asked to support (66%). Around half tie it back to their own finances — 51% say they would give more if more of their congregation tithed and 47% said if they started meeting their budget level of giving.

“We’re excited to see more and more churches not only investing in church planting but also planting reproducing churches,” said Dave Ferguson, CEO of Exponential. “These reproducing churches are prioritizing sending and releasing over addition and accumulation, which is the best way to make the greatest kingdom impact.”

For more information, view the complete report and visit LifewayResearch.com.

Methodology

The goal of the 2024 Becoming Five Multiplication Study was to objectively and statistically measure how many Protestant churches are at each of the five levels today, using a representative sample. The project was sponsored by Exponential and Thrivent.

A phone survey of 1,001 Protestant pastors was conducted by Lifeway Research on Sept. 17 – Oct. 8, 2024. The calling list used a random sample stratified by church size, drawn from a list of all Protestant churches. Quotas were used to maintain the correct proportion of each church size. Responses were weighted by region to more accurately reflect the population. Each interview was conducted with the senior pastor, minister or priest of the church called.

The survey consisted of 19 questions used to determine level assignments, plus demographics and descriptive questions. Survey questions were designed to measure actual behaviors and not aspirations or good intentions. The completed sample is 1,001 surveys. The sample provides 95% confidence that the sampling error does not exceed plus or minus 4.1%. This margin of error accounts for the effect of weighting. Margins of error are higher in sub-groups. Comparisons are made to a 2019 Lifeway Research study sponsored by Exponential.

Exponential is a growing community of leaders committed to accelerating the multiplication of healthy, reproducing faith communities. They equip movement makers with actionable principles, ideas and solutions. Exponential is passionate about accelerating multiplication through movement makers and is committed to “The 16% Mission” — to see a tipping point of 16% of churches in the U.S. becoming reproducing or multiplying churches. For more information, visit exponential.org.

(EDITOR’S NOTE — Aaron Earls is a writer for LifeWay Christian Resources.)